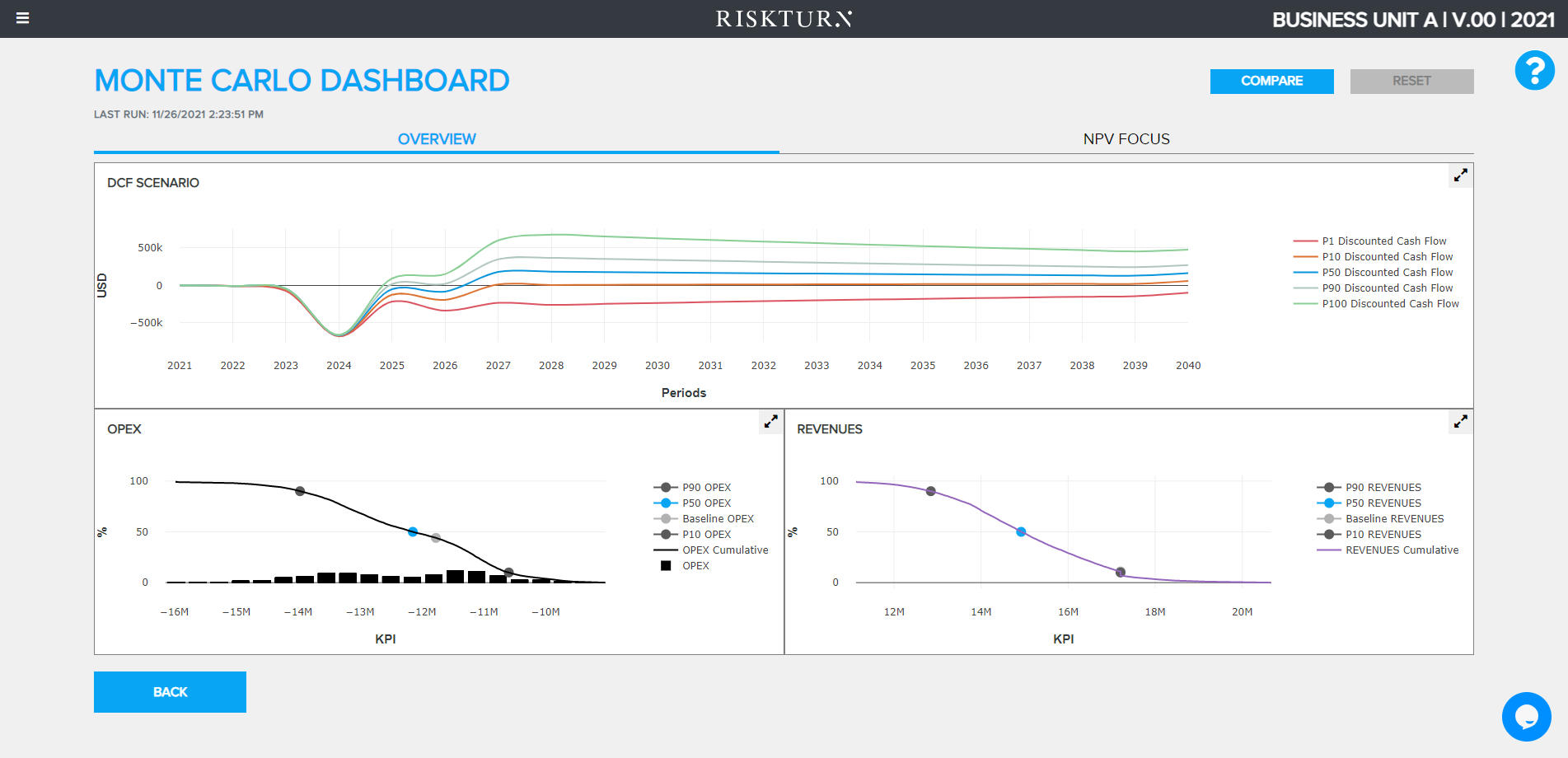

The Monte Carlo approach is the computational standard for many industries that rely on complex, multi-variable models for forecasting. Calculate thousands of future scenarios and understands where your business and investments are headed.

What is the chance of the NPV being higher than 10 M $ in the next ten years? What are the top three risk that my function should mitigate in the next five years? How impactful are they on the balance sheet?

Riskturn answers this kind of questions every day for business and investment. Riskturn’s engine computes thousands of scenarios providing a statistical, quantitative prediction.

Request a demoRiskturn runs on the Azure cloud infrastructure. We offer top-notch security standards for all your valuable data and scalable to guarantee outstanding performances at every moment.

For every client, Riskturn comes with a dedicated environment to work.

Want to discuss with our IT team?

Get in Touch

Riskturn is natively built to connect seamlessly with your business processes and tools. Import data

automatically from your ERP solutions and make it available for further processing. Find out more